There is headroom for fintech growth over the next decade as the internet economy becomes THE economy.

Over the last 7-8 years, the Indian digital payments fintech landscape has witnessed rapid growth fueled by factors such as rising smartphone penetration, cheap mobile internet data, and government initiatives promoting financial inclusion and digital literacy. And while the ubiquity of UPI is evident in everyday business exchanges, there is still significant headroom for fintech growth over the next decade as the internet economy becomes THE economy.

The digital story thus far has been centered on fintech adoption by consumers and large enterprises, the next frontier of growth will be the mid-market and SME merchant base. Mid-market alone is a $30-40 billion TPV (Total Payment Volume) opportunity and is expected to double over the next 4-5 years. Fintechs realize this, and while several merchant players have started focusing on capturing this segment, they are still scratching the surface when it comes to customized offerings for this 2 million+ strong merchant base.

Understanding the Mid-Market:

The mid-market segment, consisting of corporations generating ~₹1 to 100 crores in annual turnover, forms a critical part of the Indian economy, contributing significantly to GDP growth and employment generation. It is estimated that this segment alone is worth $30-40 billion in TPV, growing at a CAGR of 30% according to industry reports. However, the potential remains largely untapped, with banks and fintechs currently limited to vanilla payment solutions.

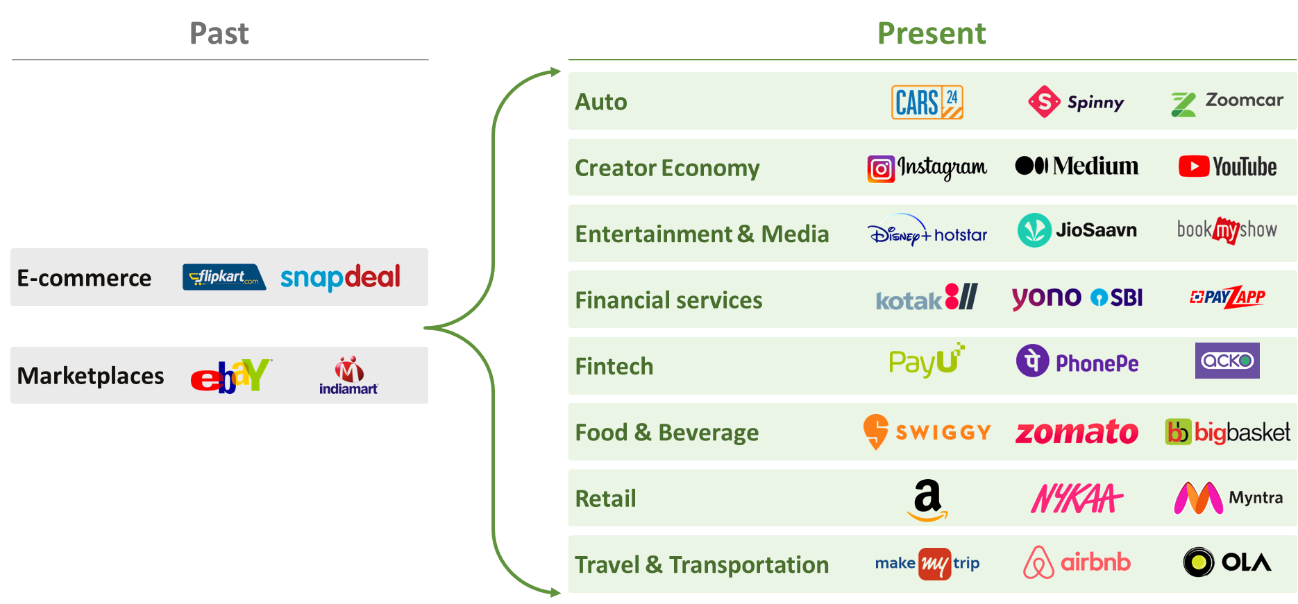

To effectively service this segment, fintechs will increasingly need to identify distinct industry segments and build tailored offerings. The opportunity exists both online and offline and verticals that are attractive from a size, growth, and unit economics standpoint include financial services, apparel, electronics, D2C, health tech, gaming, travel, and education Each of these verticals are sizeable sub-markets but with different merchant pain points and challenges. Fintechs that can solve for product proposition, operations, and service offering, an effective go-to-market approach will be well positioned to capture market share.

Segment-Specific Product Build:

As merchant scale varies from large to mid-market and SMEs, the expectations and priorities from payments partners change. For large enterprises stability and scalability of the tech platform, the breadth of payment methods offered, and the customizability of checkout are important. On the other hand, among other things, SMEs are looking for easy onboarding and integration, and Value-added services (VAS) like lending. To gain a competitive edge in the mid-market segment, players will likely need to adopt a full-stack approach.

This involves offering a comprehensive suite of solutions that go beyond basic payment processing. Services like vendor payments, payroll solutions, dashboards with 360-degree business visibility across channels, and customized lending options are just a few examples of the additional offerings. These will also need to be customized to the industry segment. For instance, the integration of VAS, such as inventory management systems and accounting software, can help mid-market businesses streamline their operations and enhance efficiency. By becoming a one-stop solution for the financial needs of mid-sized businesses, fintechs can establish themselves in a segment that has lower price elasticity, and rewards service offerings with higher wallet share.

Easy Integration with Strong Service:

Seamless integration and strong customer service are oft-overlooked parameters for success. Fintechs need to prioritize easy integration options that allow businesses to seamlessly connect with the fintech platform. Offering robust APIs, developer-friendly documentation, and dedicated support can significantly enhance the experience and reduce onboarding friction for merchants. Additionally, investing in exceptional customer service is crucial for building trust and maintaining strong relationships. According to an academic research paper titled ‘Customer’s Attitude and Fintech Industry Adoption', 78% of businesses consider customer service a key factor in choosing fintech providers and 68% value prompt issue resolution.

Internally monitoring and tracking key performance indicators (KPIs) such as Net Promoter Score (NPS), products per merchant, and cohort-wise retention rates can provide valuable insights into the satisfaction levels of mid-sized business customers. Fintechs can use robust data monitoring as an asset to continuously improve their offerings, provide superior customer experience, and adapt to evolving market dynamics.

The merchant opportunity for Indian fintech is vast and rapidly growing, and the next phase of growth is expected to come from more broad-based merchant digitization. Number of MSMEs conducting businesses online is currently only <10%. As this rises 2-3x over the next 5 years, fintechs will need to evolve from just payment solution providers to trusted business partners catering to the broader financial services needs of these segments.

Therefore, these are exciting times for Indian fintech to seize the opportunity, armed with insightful strategy, bespoke product offerings and actionable GTM, unlock this potential, and contribute to the Digital India mission.