Could we digitize discovery, verification and repayment of over Rs. 1 Lakh Crore worth of funds lying unclaimed in India?

Over Rs. 1 lakh crore(1) of funds are lying unclaimed in Indian bank accounts, insurance companies, provident fund, mutual funds, stocks, matured fixed deposits and dividends. Yes, let that number settle in. For context, this amount is more than India’s healthcare budget for the FY 23-24 (2).

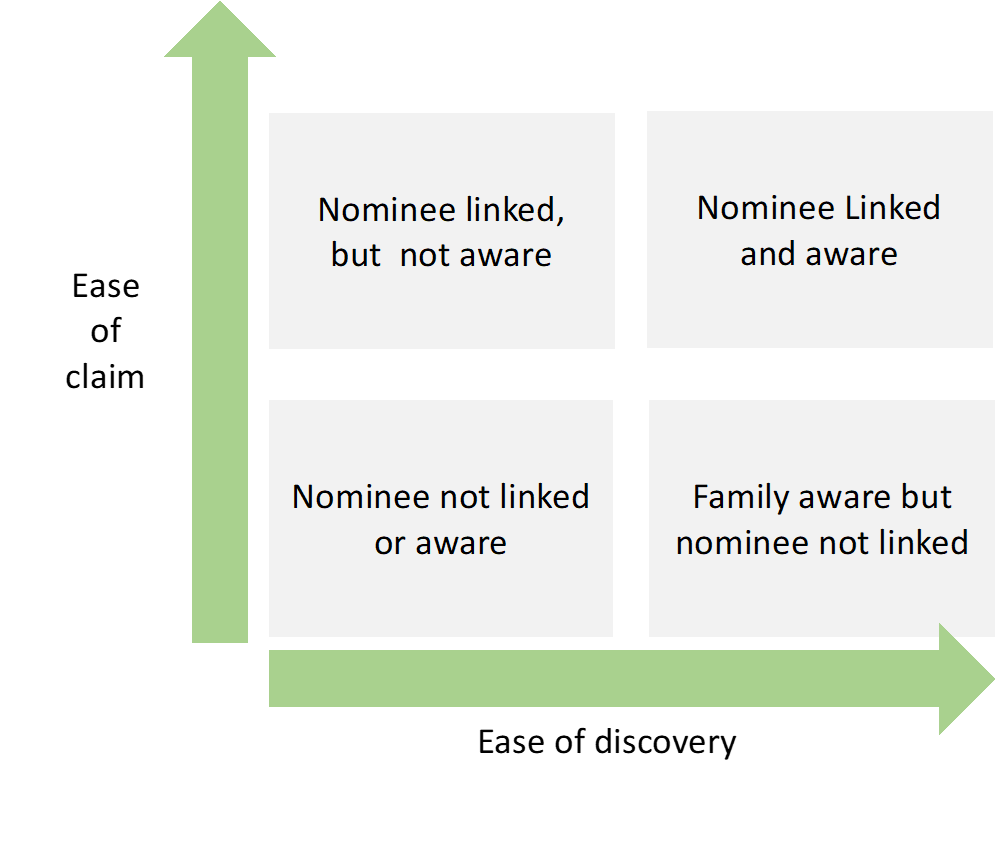

Most of these funds are lying unclaimed because of the lack of knowledge or the lack of linking a nominee. As a business school graduate, I would be remiss if I don’t add a 2 by 2 matrix to qualify my thoughts.

So here it goes:

If the nominee is aware and the account is linked to a nominee, claiming such assets (placed in the top right quadrant) is the easiest. But, in case the nominee is not linked, the process becomes far more tedious as you need to work with a lawyer and a district magistrate to prove that you are the legal heir and there is no objection from other next of kin. The drive for linking of nominees is solving for this problem for the future but what about the past? The past that has led to Rs. 1 crore of unclaimed funds.

Here is a breakup of all the unclaimed assets:

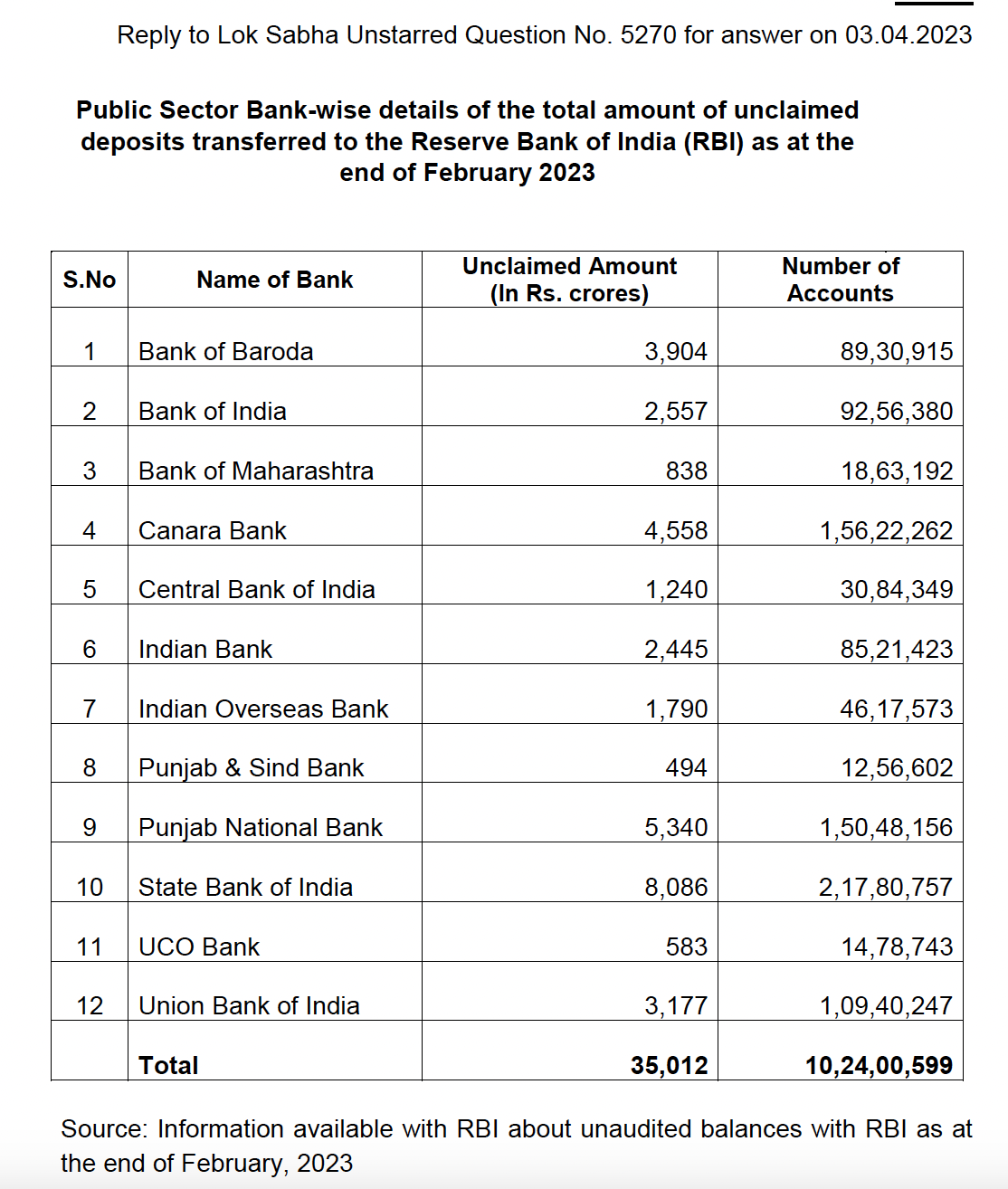

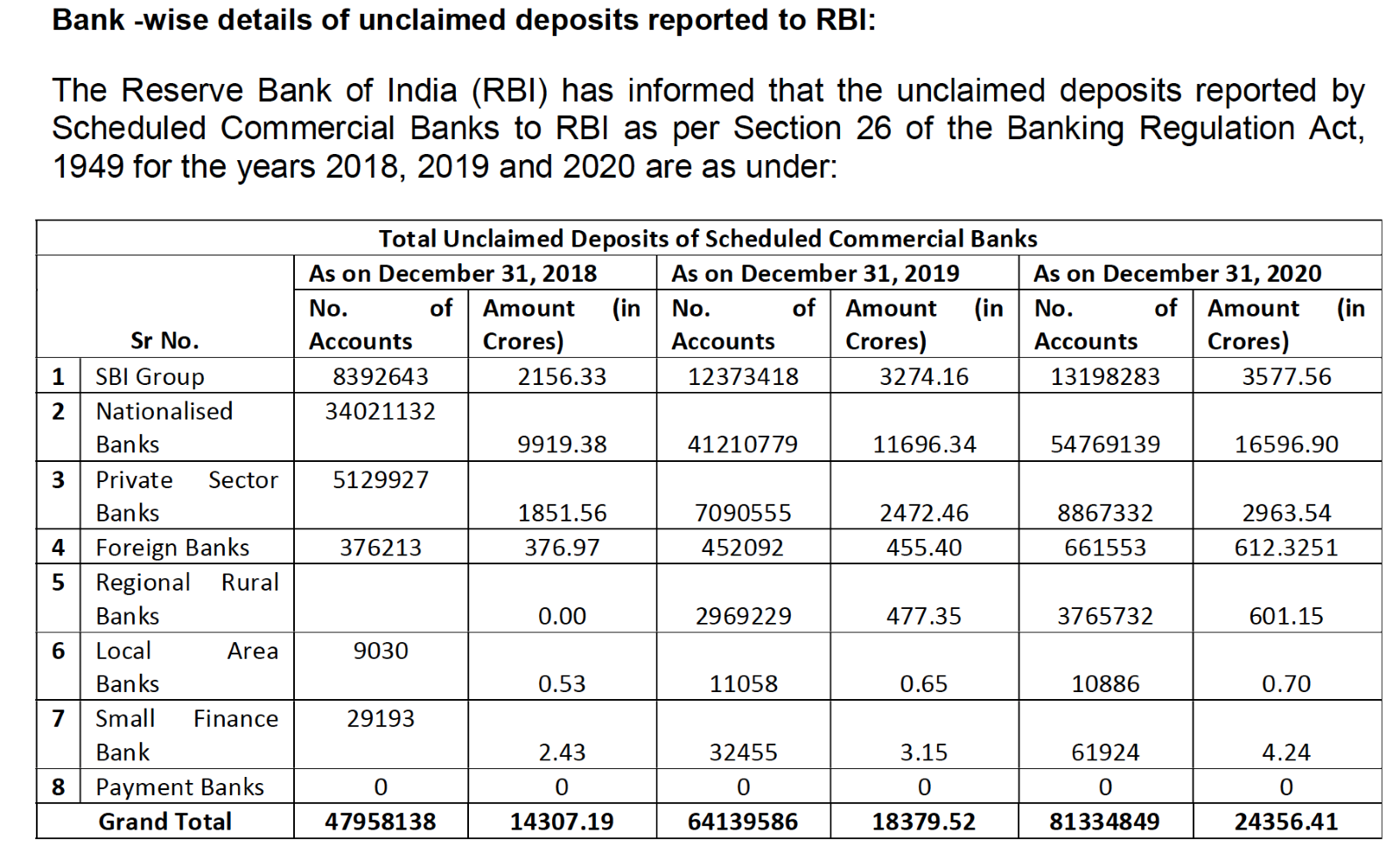

- Bank Deposits – Public sector banks have more than 35 thousand crores lying unclaimed in over 10 crore accounts with public sector banks(3). Add to this about 20%(4) more with private, foreign, small finance and regional rural banks, the unclaimed amount in bank deposits are over 40 thousand crore.

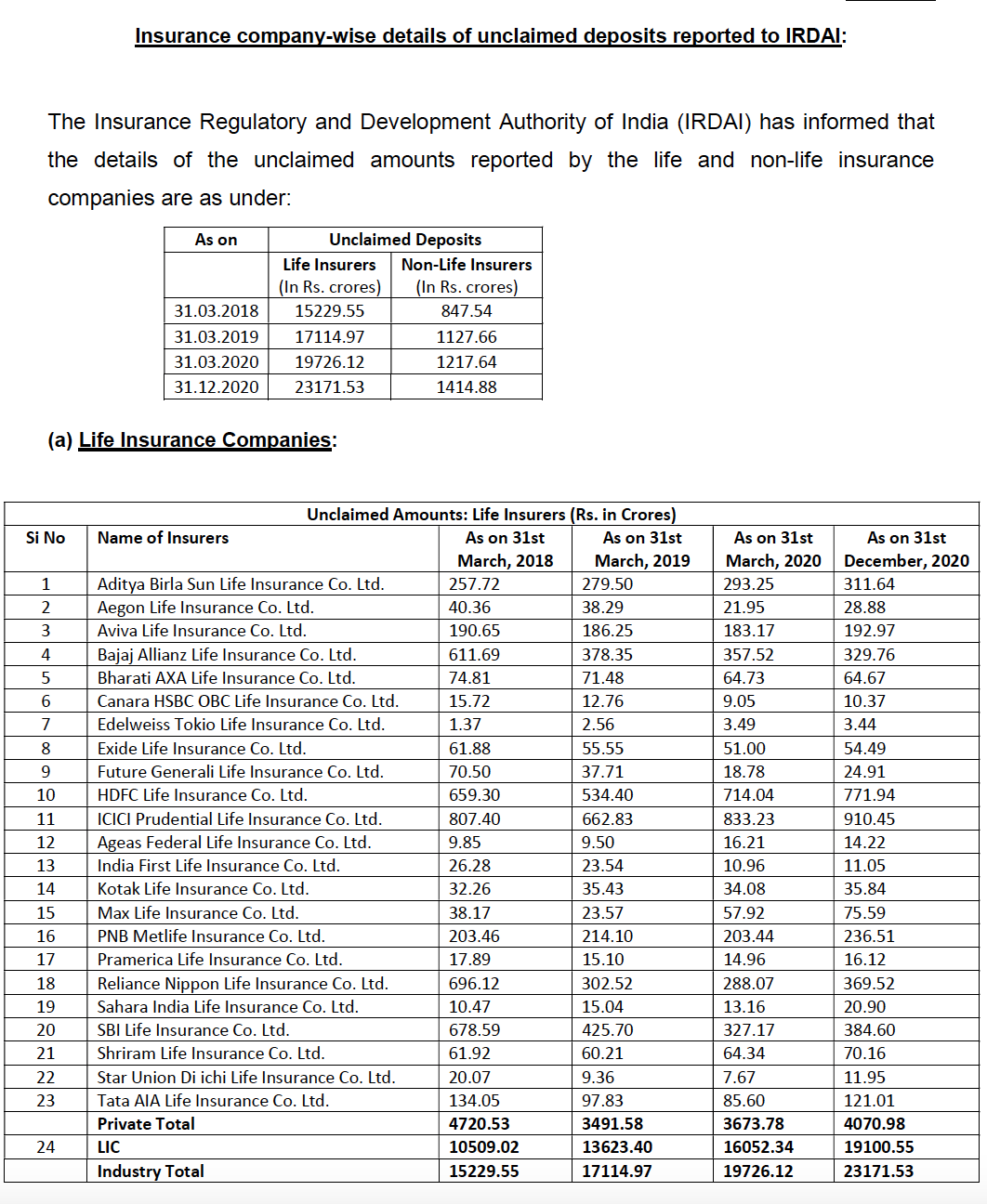

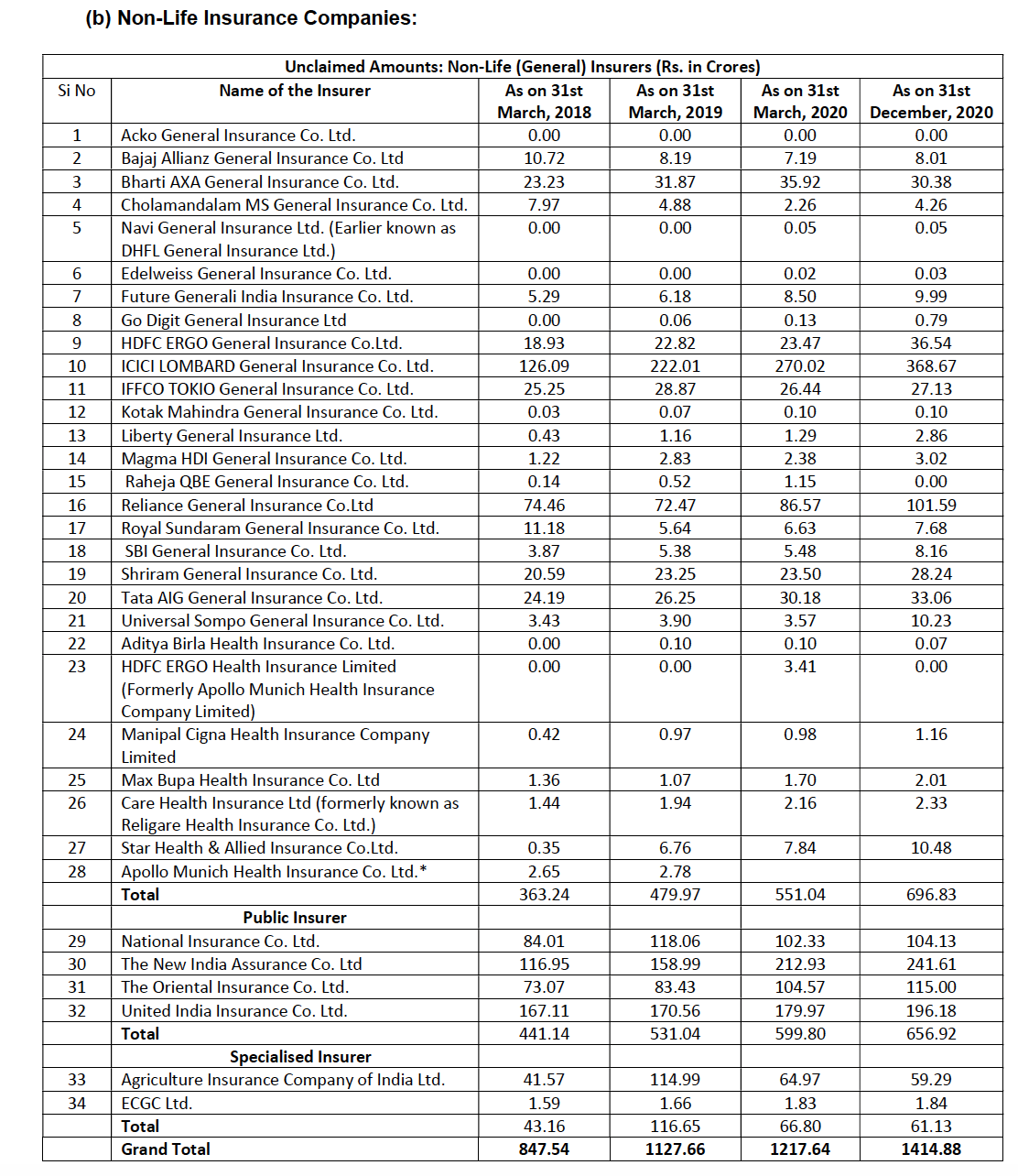

- Insurance – LIC alone has over 21 thousand crores(5) in unclaimed life insurance amounts. Since, LIC is about 75%(6) of the life insurance market in India, unclaimed life insurance amounts could be to the tune of 28 thousand crores. Add to that unclaimed amount of about 2 thousand crore with non-life insurance providers. We have a 30 thousand crore unclaimed amount in insurance.

- EPFO - The Employees' Provident Fund Organization (EPFO) is also sitting on a massive Rs 26 thousand crore in inoperative PF accounts(7).

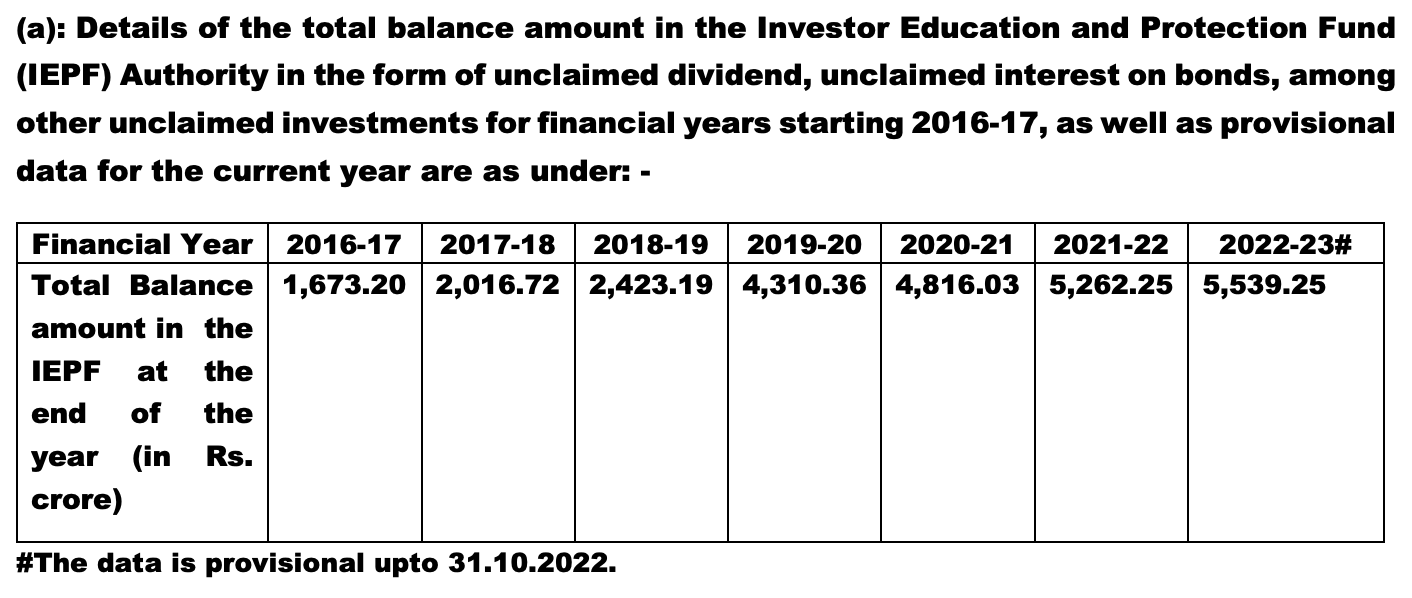

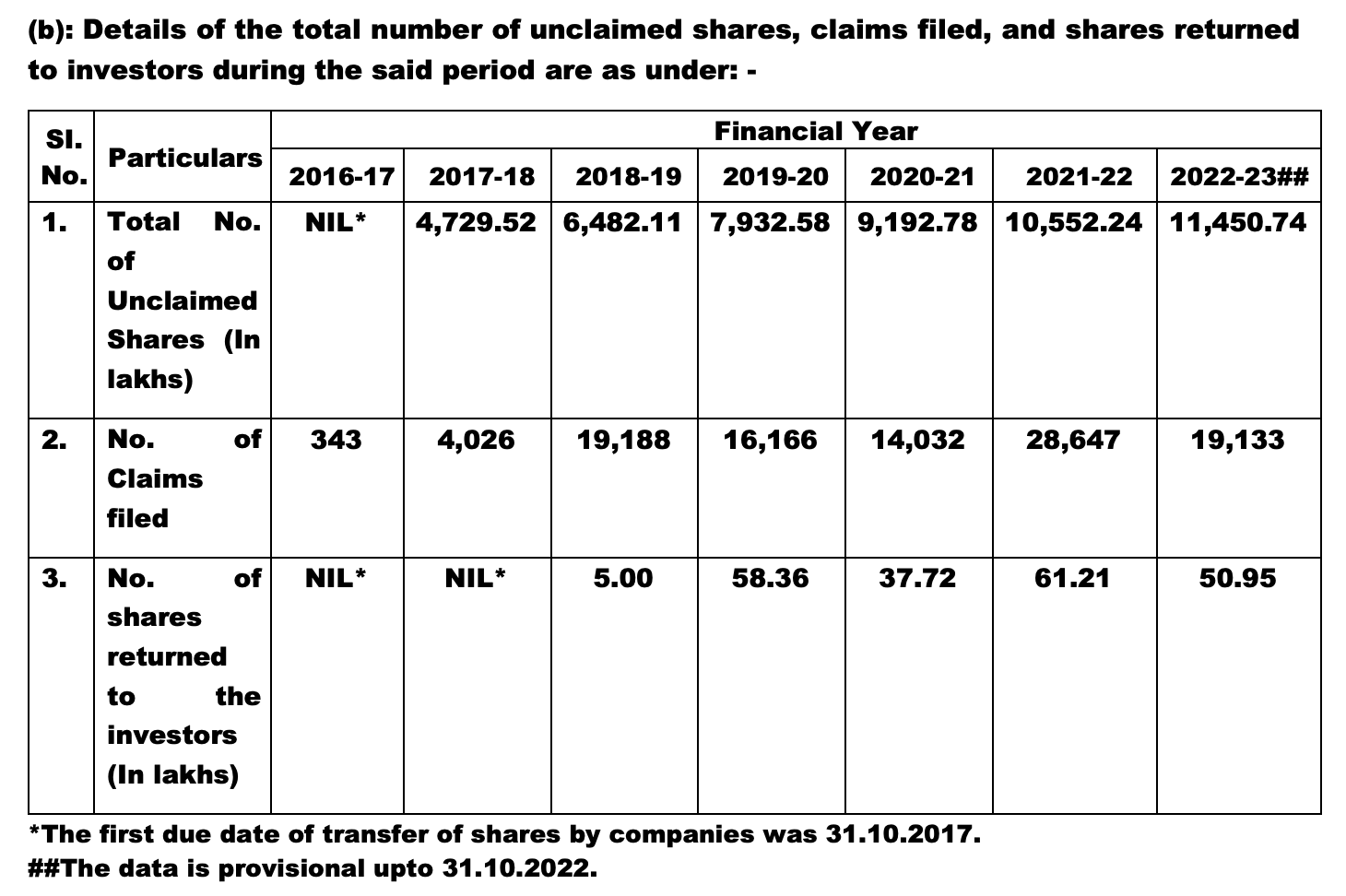

- Investments – The Investor Education Protection Fund (IEPF) has more than 5 thousand crore(8) lying unclaimed in over 114 crore unclaimed shares

Now, what happens to all these funds that are unclaimed:

- Bank deposits: In pursuance of the amendment to the Banking Regulation Act, 1949 and insertion of Section 26A in the said Act, RBI has framed the Depositor Education and Awareness fund (DEAF) Scheme, 2014. The scheme was notified in the official gazette on 24.05.2014. The banks calculate the cumulative balances in all accounts which are not operated upon for a period of 10 years or more along with interest accrued and transfer such amounts to the DEAF. In case of demand from a customer whose unclaimed deposit had been transferred to the DEAF, banks are required to repay the customer, along with interest if any, and lodge a claim for refund from the DEAF

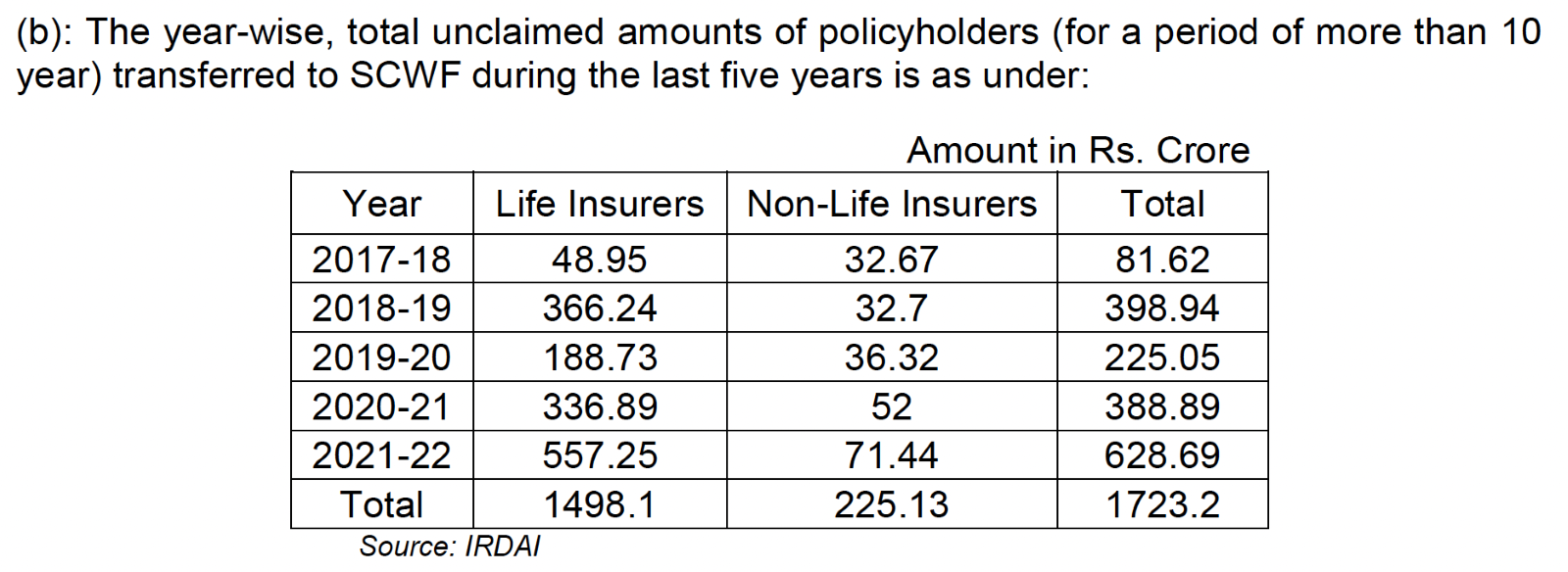

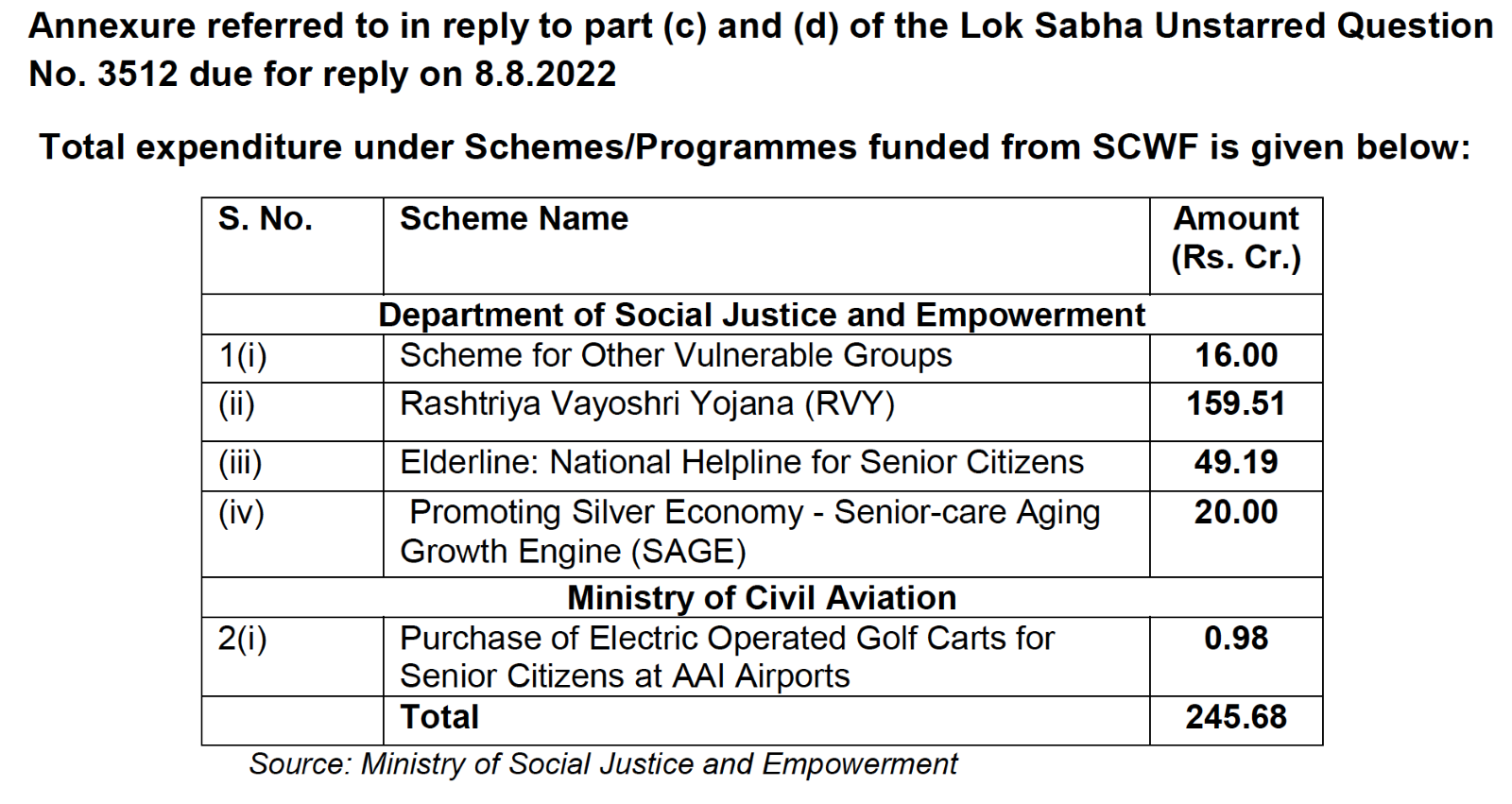

- Insurance: Unclaimed insurance claims are transferred to Senior Citizens’ Welfare Fund (SCWF) and unclaimed investments to Investor education protect fund (IEPF). As per the provisions of Senior Citizens’ Welfare Fund Rules, 2016 notified by the Government of India and a Master Circular dated 25.7.2017 issued by the Insurance Regulatory and Development Authority of India, all insurers, who have unclaimed amounts of policyholders for a period of more than 10 years as on 30.9.2017 are required to transfer the same with interest to the Senior Citizens’ Welfare Fund (SCWF) every year. Further, even after transfer of the unclaimed amounts to the Fund, a policyholder or claimant continues to be eligible to claim the unclaimed amounts under their respective policies for a period of up to 25 years. The year-wise transfer to this fund has increased from 80 crore 5 years ago to over 600 crore last year. Only 245 crore of these funds have been used till date.

- Investments: The Central Government under Section 125 of the Companies Act, 2013 has set up Investor Education and Protection Fund Authority (IEPF) on 7th September, 2016 with the objective of promoting investor education, awareness, protection and to make refund of claim to the investors. As per Section 124(5) of the Companies Act, any money which remains unpaid or unclaimed for a period of 7 years from the date of transfer to the unpaid dividend account of the company, the company is required to transfer such amount to Investor Education & Protection Fund (IEPF).

- EPFO - A PF account is classified as inoperative if there is no deposit for more than three years. Under a new rule introduced in 2011, no interest is payable on the balance in an inoperative account. The claim can be made to the EPFO using this link: https://www.epfindia.gov.in/site_en/WhichClaimForm.php

The government has taken steps to digitize the discovery and claims process.

- Each bank already displays unclaimed bank accounts on their website. Now, RBI is building a portal so that unclaimed deposits in all banks can be tracked at one place(9).

- RBI has also recommended that banks take a pro-active approach by tracking down customers or legal heirs in relation to accounts that have become inoperative, or where there have been no transactions for at least two years

- RBI has launched 100 days 100 pays campaign to ask banks to return deposits to their top 100 depositors in each district.(10)

So, why is this such a hard problem to solve even though the government is putting it’s might behind it?

The answer comes from examining the on-ground claim experience. Let’s evaluate a few scenarios:

- Account owner is alive: Although the government is focusing on discovery, it was a problem that was already solved for to a large extent. You can go to any bank's website to discover your or anyone else’s inoperative account details. Try it here for SBI accounts. The challenge is once you discover unclaimed balances even in accounts where the customer is alive, you must visit the bank branch to verify the identity and then claim the transfer.

- Account owner not alive, but nominee is linked: The nominee needs to produce the death certificate of the deceased and his KYC documents to lay claim. In some cases they may also need to prove that they are the legal heir or there is no objection from the legal heir/s. (Process in Annexure 6)

- Account owner not alive, and nominee is not linked: This makes the process extremely tedious as the claimant needs to prove that she or he is the legal heir. (Process in Annexure 6)

Additionally, the banking industry operates on net interest margin i.e. difference between interest paid and interest received, adjusted for the total amount of interest-generating assets held by the bank. If they hold more assets, they can lend more. Therefore, it is not in a financial institution’s interest to give money back or out of the accounts held with the bank.

How can Fintech companies help solve the problem?

The ease of discovery can be solved for by simply any large consumer payment application allowing you to discover your and your family’s unclaimed assets by calling the government database.

This is a simple call made to RBI’s new central portal.

But, could verification be done using one identifier to establish the nominee’s identity? The Finance Minister of India, recently spoke of a one-stop solution for updating of identity and address of individuals using Digilocker and Aadhar as foundational identity. Account aggregator as the financial identity of everyone could also solve a part of the problem by taking customer’s consent and linking a nominee mandatorily.

If the verification and claim process can be handled digitally, it can solve for most of the problem related to on ground experience and the hassle of claim and transfer. The IEPF has made some changes to this effect(11).

The problem of transfer is easy after that. India’s Jan Dhan, Aadhar and Mobile (JAM) trinity has ensured that we do close to 10 Mn direct benefits transfers every day. Once the identity is established, the transfer to the rightful owner should be easy.

Therefore, could we have someone solve this by digitizing discovery, verification, and repayment of claims to the rightful owners?

Well, that is the 1 lakh crore rupee question!

References

- Shocking! Value of unclaimed deposits, shares and dividends exceed Rs 1 lakh crore, details: https://www.dnaindia.com/personal-finance/report-shocking-value-of-unclaimed-deposits-shares-and-dividends-exceed-rs-1-lakh-crore-check-details-3041233

- Demand for Grants 2023-24 Analysis : Health and Family Welfare, PRS, https://prsindia.org/budgets/parliament/demand-for-grants-2023-24-analysis-health-and-family-welfare

- Reply to Lok Sabha Unstarred Question No. 5270 for answer on 03.04.2023, https://sansad.in/getFile/loksabhaquestions/annex/1711/AU5270.pdf?source=pqals

- UNSTARRED QUESTION NO. 2119 TO BE ANSWERED ON MONDAY, 2nd AUGUST, 2021/ 11 SRAVANA 1943 (SAKA UNCLAIMED DEPOSITS, https://sansad.in/getFile/loksabhaquestions/annex/176/AU2119.pdf?source=pqals

- UNSTARRED QUESTION NO. 1890, Lok Sabha, ANSWERED ON – 14.3.2022, UNCLAIMED FUNDS OF LIC, https://pqars.nic.in/annex/256/AU3736.pdf

- UNSTARRED QUESTION NO. 2119 TO BE ANSWERED ON MONDAY, 2nd AUGUST, 2021/ 11 SRAVANA 1943 (SAKA UNCLAIMED DEPOSITS, https://sansad.in/getFile/loksabhaquestions/annex/176/AU2119.pdf?source=pqals

- Rs 64,000 crore idle wealth lying unclaimed: Here's how you can claim it, By: Preeti Kulkarni, https://economictimes.indiatimes.com/analysis/rs-64000-crore-idle-wealth-lying-unclaimed-heres-how-you-can-claim-it/tomorrowmakersshow/45332770.cms#:~:text=If%20you%20add%20the%20Rs,crore%20in%20interest%20every%20year

- GOVERNMENT OF INDIA, MINISTRY OF CORPORATE AFFAIRS, LOK SABHA, UNSTARRED QUESTION NO. 837, ANSWERED ON MONDAY, DECEMBER 12, 2022/ AGRAHAYANA 21, 1944 (SAKA), UNCLAIMED FUND WITH IEPF, https://pqals.nic.in/annex/1710/AU837.pdf

- RBI to develop online portal for unclaimed deposits of all banks, By Sneha Kulkarni: https://economictimes.indiatimes.com/wealth/save/rbi-to-develop-online-portal-for-unclaimed-deposits-of-all-banks/articleshow/99286209.cms?from=mdr

- Banks to launch 100 days campaign to trace & settle unclaimed deposits: RBI, https://economictimes.indiatimes.com/industry/banking/finance/banking/banks-to-launch-100-days-campaign-to-trace-settle-unclaimed-deposits-rbi/articleshow/100192072.cms

Annexure 1

Annexure 2 – GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS LOK SABHA UNSTARRED QUESTION NO. 837 ANSWERED ON MONDAY, DECEMBER 12, 2022/ AGRAHAYANA 21, 1944 (SAKA) UNCLAIMED FUND WITH IEPF

Annexure 3 - GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS LOK SABHA UNSTARRED QUESTION NO. 837 ANSWERED ON MONDAY, DECEMBER 12, 2022/ AGRAHAYANA 21, 1944 (SAKA) UNCLAIMED FUND WITH IEPF

Annexure 4 - GOVERNMENT OF INDIA, MINISTRY OF FINANCE, DEPARTMENT OF, FINANCIAL SERVICES, LOK SABHA, UNSTARRED QUESTION NO. 3512, ANSWERED, ON – 8.8.2022, UNCLAIMED INSURANCE AMOUNTS, 3512. SHRIMATI SUMALATHA AMBAREESH

Annexure 5 - UNSTARRED QUESTION NO. 2119 TO BE ANSWERED ON MONDAY, 2nd AUGUST, 2021/ 11 SRAVANA 1943 (SAKA UNCLAIMED DEPOSITS https://sansad.in/getFile/loksabhaquestions/annex/176/AU2119.pdf?source=pqals

[Text Wrapping Break]Annexure 6 - Settlement of Death Claim - Union Bank of India

Operations Department, World Trade Centre, Cuff Parade, Mumbai.

Settlement of Death Claim –Procedure, Guidelines and List of Documents

- Background: Death of a person is a turbulent period, both mentally and financially, for the members of the bereaved family. Speedy disposal of claim petitions of deceased depositors would be a solace to the legal heirs/nominee/survivor of the deceased depositor. The Bank has adopted the policy of effective and efficient handling of claim petitions by branches while ensuring that the money of deceased depositor is claimed by the proper persons who are entitled thereto. As service oriented bankers, it becomes our duty to properly guide the registered nominees/legal heirs.

- Coverage The Death Claim guidelines shall cover the claim settlement function of all the Domestic Branches/Offices of the Amalgamated Entity.

- Methods of Settlement: A claim on the credit balance or the assets of a customer can be settled in any one of the following ways:

- Payment to Nominee:

- Where there is valid nomination, Bank is fully discharged by making payment to the nominee.

- Claims and counter claims by legal heirs and others need not be taken into cognizance unless a Court Order is produced.

- Payment to nominee can be stopped by producing a valid Court order.

- Nomination is introduced solely for the purpose of simplifying the procedure for Settlement of claims of deceased depositors and nomination facility does not take away the rights of legal heirs on the estate of deceased. The nominee receives the payment as a trustee of the legal heirs and the latter have the right to claim the amount from him.

- Payment to Legal Heirs on production of Legal Representation:

- Legal representation: It is a Court Order empowering certain person/s to collect the amounts due to the deceased such as Probated Will, Letter of Administration or Succession Certificate.

- Probated Will: It is a copy of the will certified under the seal of the Court of competent jurisdiction confirming that the will has been duly executed and has the force to be acted upon. It is the legal process/court order administering the estate of a deceased person by resolving all claims and distributing the deceased person’s property under a valid Will. Bank to act as per the probate/court order.

- Letter of Administration : Where there is no will or When a person dies leaving a Will without appointing an executor or if an executor appointed by a Will is legally incapable or refused to act or who has died before the testator or before he has proved the Will, an administrator can be appointed by a competent court as distinguished from an executor who can be appointed by a person by his Will or codicil

- Succession Certificate: It is a Certificate/order issued by a Court of competent declaring the names of legal heirs of a deceased person and percentage of their share in the property of the deceased. A succession certificate is a document which gives authority to a person named in the document to collect “debts and securities” (i.e. credit balances & transferable securities) due to deceased person.

- When a Legal Representation/court order is produced, Bank is bound to make payment to the persons mentioned therein as per terms of legal representation. Bank gets valid discharge by making such payments.

- As per RBI·s directives, for claims of deposit balance or any credit balance or any other asset of the deceased irrespective of amount, banks should not insist on Legal Representation.

- Where all the legal heirs are not joining together for claim or if there is a dispute, then only, Bank should ask for a court order.

- Payment to Legal Heirs in the absence of Legal Representation

- It involves making payment to the legal heirs when:

a. The depositor dies intestate (not leaving behind any will)

b. There is no nomination

c. There is no Legal Representation/Court order

- The branch should settle the claim without insisting on the production of Legal Representation which results into the undue hardship to the claimant provided all legal heirs have joined in the claim.

- The branch manager may consider the claim, where he is fully satisfied, after independent inquiries that all legal heirs/legal representatives have joined the claim and that there are no other claimants to the estate/assets to the deceased.

- Procedure for payment

- Payment to Nominee:

- Documents required to be taken are as below:

- Application form

- Original death Certificate issued by appropriate authority

- Proof of identification of nominee(s) wherever is applicable such as Election ID Card, PAN Card, Aadhaar Card(UID), Passport etc., or any other satisfactory proof of identification acceptable to the Branch.

- Proof of Address such as Aadhaar Card (UID), Passport, Election ID etc.

- Payment to Legal Heirs on production of Legal Representation

- Documents required to be taken are as below:

- Estate Claim Form

- Original death Certificate issued by appropriate authority

- Proof of identification of nominee(s) wherever is applicable such as Election ID Card, PAN Card, Aadhaar Card(UID), Passport etc., or any other satisfactory proof of identification acceptable to the Branch.

- Proof of Address such as Aadhaar Card (UID), Passport, Election ID etc.

- Certified copy of the legal representation.

- Payment to Legal Heirs in the absence of Legal Representation

- Procedure for claim up to and inclusive of Rs.5000/

- Documents required to be taken are as below:

- Estate Claim Form

- Original death Certificate issued by appropriate authority

- Proof of identification of nominee(s) wherever is applicable such as Election ID Card, PAN Card, Aadhaar Card(UID), Passport etc., or any other satisfactory proof of identification acceptable to the Branch.

- Proof of Address such as Aadhaar Card (UID), Passport, Election ID etc.

- When Branch Manager is fully satisfied about the identity, integrity and bonafides of the claimants after due enquiry, he can settle the claim up to Rs.5000/- without insisting for legal heir certificate, affidavit and Indemnity Bond.

- Only a Declaration to be obtained in Annexure-X (To be stamped as an agreement)

- For claims above Rs.5000/- and upto & inclusive of Rs. 50,000/

- Documents required to be taken are as below:

- Estate Claim form

- Original death Certificate issued by appropriate authority.

- Proof of identification of nominee(s) wherever is applicable such as Election ID Card, PAN Card, Aadhaar Card(UID), Passport etc., or any other satisfactory proof of identification acceptable to the Branch.

- Proof of Address such as Aadhaar Card (UID), Passport, Election ID etc.

- Legal Heir Certificate (not mandatory)

- Affidavit stating that the deceased died intestate and there are no other legal heirs other than the one mentioned therein (to be stamped as per local Law). Affidavit to be executed before a Notary/Magistrate/other Officer authorized by State Government (as per Annexure-VII).

- Indemnity Bond signed by all legal heirs and two sureties. The means of the sureties should not be less than double the claim amount (credit information to be obtained & credit report to be compiled). Indemnity Bond to be stamped as per the local laws (as per Annexure-VIII).

- For Claims above Rs. 50,000/

- Documents required to be taken are as below:

Wherever the claimants are finding it difficult/not able to obtain legal heir certificate from the revenue authorities, the claim can be settled by obtaining the following documents:

- Estate Claim form

- Original death Certificate issued by appropriate authority.

- Proof of identification of nominee(s) wherever is applicable such as Election ID Card, PAN Card, Aadhaar Card(UID), Passport etc., or any other satisfactory proof of identification acceptable to the Branch.

- Proof of Address such as Aadhaar Card (UID), Passport, Election ID etc.

- Affidavit to be executed by all the legal heirs (Annexure-VII). (To be executed before a Notary/Magistrate on Non-Judicial Stamp paper).

- Indemnity Bond to be executed by all the legal heirs along with two sureties having means of not less than double the claim amount (Annexure-VIII). (To be executed before a Notary/Magistrate on Non-Judicial Stamp paper).

- A declaration to be obtained from the respectable person/s well known to the deceased family and the bank preferably an existing depositor of the bank, to the effect that the claimants are the only legal heirs of the deceased (Annexure-IX) (To be stamped as an agreement- Need not be signed before Notary or Magistrate).

- Action by Branch after submission of documents:

- If required, Branch officials may visit the place of the depositors to enquire about the genuineness of claims.

- Branch Official would verify the authenticity and genuineness of all the documents.

- Branch Official may ask for additional information/documents that they may deem fit for settlement of the claim

- In case of Nomination, payment would be made by the Branch Manager to the nominee(s) subject to the foregoing conditions irrespective of the amount standing to the credit of the deceased account holder.

- Payment would be made to the nominee(s) through “Account Payee only” Pay Order/Demand Draft after getting a receipt.

- Settlement of Death Claims (Covid Related): In case of COVID related death claim settlement two additional documents as under are to be provided:

- Application Form for COVID

- COVID Annexure II

- Time Norms for settlement of claims: TAT for settlement of Death Claim is 15 days from the date of submission of all documents.

- Legal Heirs: In the absence of a Common Civil Code, who is legal heir of a deceased person depends upon his/her personal law. A summary of legal heirs/rules of succession in case of Hindus, Muslims, Christians and Parsis is given in Appendix-A.

## To view and download the formats of various type of documents please visit the “Documents List” Tab.